Navigating Property Investment: A Guide for Foreign Buyers

Investing in Australian property as a foreign buyer involves navigating a complex regulatory landscape, including compliance with taxation and property laws. Sunstate Conveyancing offers expert guidance to ensure that foreign investors understand their obligations and can make informed decisions when buying property in Australia. This article explores key requirements and processes, including the necessity for various clearance certificates and understanding capital gains implications.

Essential Compliance for Foreign Property Buyers in Australia

Foreign Investment Review Board (FIRB) Approval Foreign buyers must generally obtain approval from the FIRB before purchasing property in Australia. This ensures that the investment is in line with Australian residential property regulations.

Capital Gains Withholding Clearances When a foreign resident sells Australian property, the buyer is required to withhold a portion of the sale price and remit it to the Australian Taxation Office (ATO) as a precaution against capital gains tax liabilities.

Understanding Various Certificates and Forms

Foreign Resident Capital Gains Withholding Clearance Certificate: This certificate is necessary for foreign residents to ensure that withholding is not required from the sale of taxable Australian property.

Foreign Resident Withholding Certificate: This certificate is required when the buyer needs to withhold a portion of the purchase price to meet the seller’s potential tax liabilities.

Key Steps and Certificates for Foreign Buyers

Acquiring a Foreign Clearance Certificate A Foreign Clearance Certificate ensures that the foreign buyer has complied with all Australian property ownership regulations.

Applying for a Foreign Resident Capital Gains Withholding Clearance Foreign sellers need to apply for this clearance to confirm their tax status and determine their obligations regarding capital gains tax withholding.

Compliance with Capital Gains Tax Obligations Foreign investors are subject to capital gains tax on any profits made from Australian property, which necessitates accurate financial planning and compliance.

FAQs for Foreign Buyers in Australia

Q1: What is a Foreign Resident Capital Gains Withholding Clearance Certificate?

It’s a document that, if obtained, exempts the buyer from withholding a portion of the sale price as a preemptive capital gains tax payment to the ATO.

Q2: How do foreign buyers apply for FIRB approval?

Foreign buyers must submit an application through the FIRB’s online portal, detailing the type and value of the property they intend to purchase.

Q3: What are the consequences of not obtaining a Foreign Clearance Certificate?

Failing to obtain this certificate can lead to legal penalties and complications in the property transfer process.

Q4: Are there any exemptions from capital gains withholding for foreign sellers?

Yes, foreign sellers can apply for an exemption if they believe withholding is not necessary, typically through a clearance certificate.

Q5: How can foreign investors ensure compliance with Australian property laws?

Consulting with a qualified conveyancing firm like Sunstate Conveyancing is advised to navigate the regulations and ensure all legal obligations are met.

Q6: Can foreign buyers finance their property purchase with an Australian mortgage?

Yes, but they must meet specific lending criteria set by Australian financial institutions, which might include higher deposit requirements.

Q7: What happens if a foreign buyer does not comply with FIRB regulations?

Non-compliance can result in fines, legal sanctions, and the potential reversal of the property transaction.

Q8: How long does it take to obtain a Foreign Resident Withholding Certificate?

Processing times can vary, but applicants should allow several weeks to ensure they receive the certificate before the property transaction concludes.

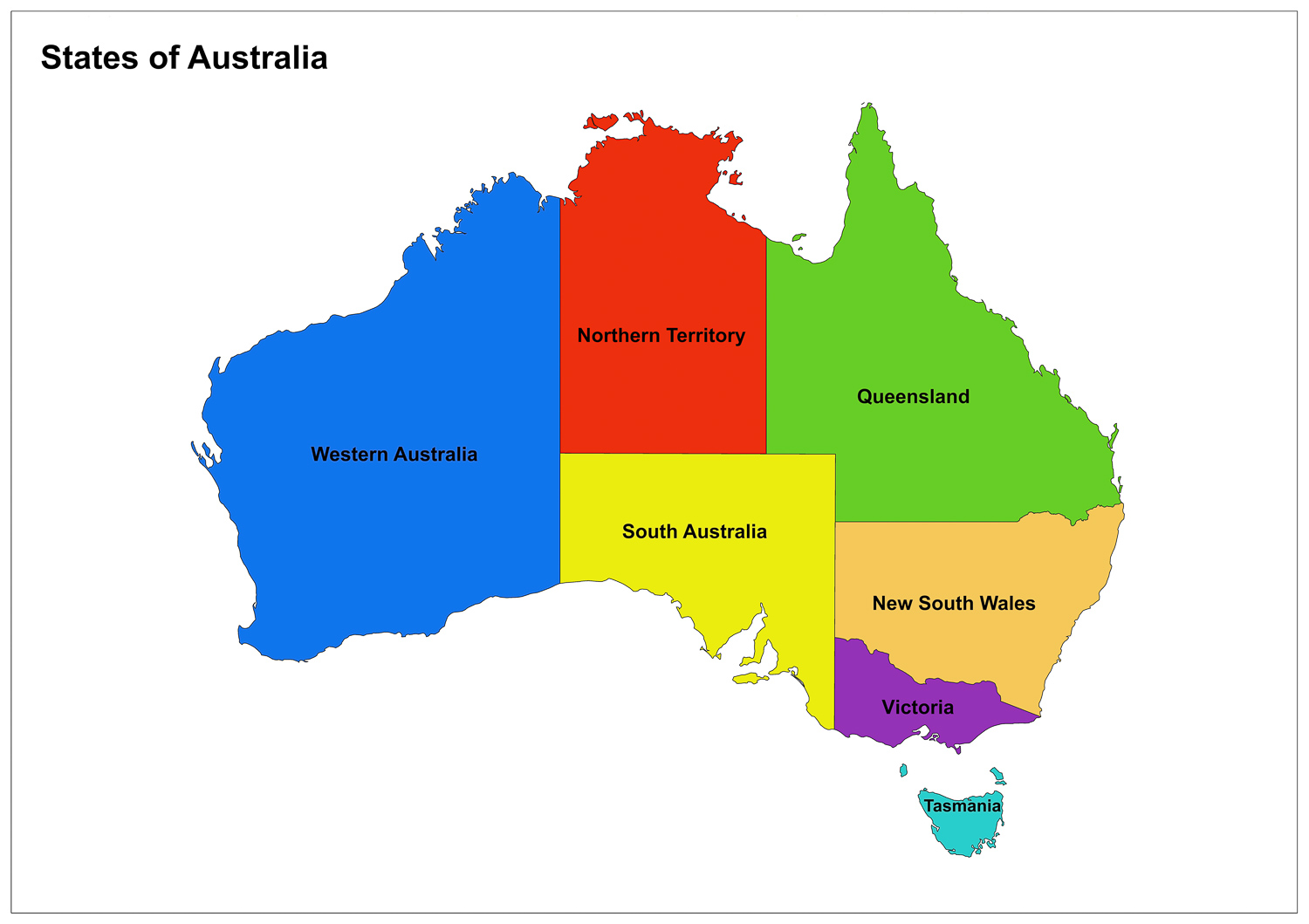

Q9: Do foreign buyers pay higher stamp duty in Australia?

Yes, foreign buyers may be subject to additional stamp duty charges, known as surcharges, which vary by state.

Q10: What is the role of Sunstate Conveyancing in assisting foreign buyers?

Sunstate Conveyancing helps navigate the complexities of property transactions, ensuring compliance with all legal requirements and offering strategic advice tailored to foreign investors.

Navigating the purchase of Australian property as a foreign investor involves understanding detailed regulatory requirements. With the expert guidance of Sunstate Conveyancing, foreign buyers can confidently invest in Australian real estate, ensuring all legal obligations are met and their investment is secure.

This is general advice only, for specific legal advice speak with your legal representative.