What’s Happening with Property Prices in Aus?

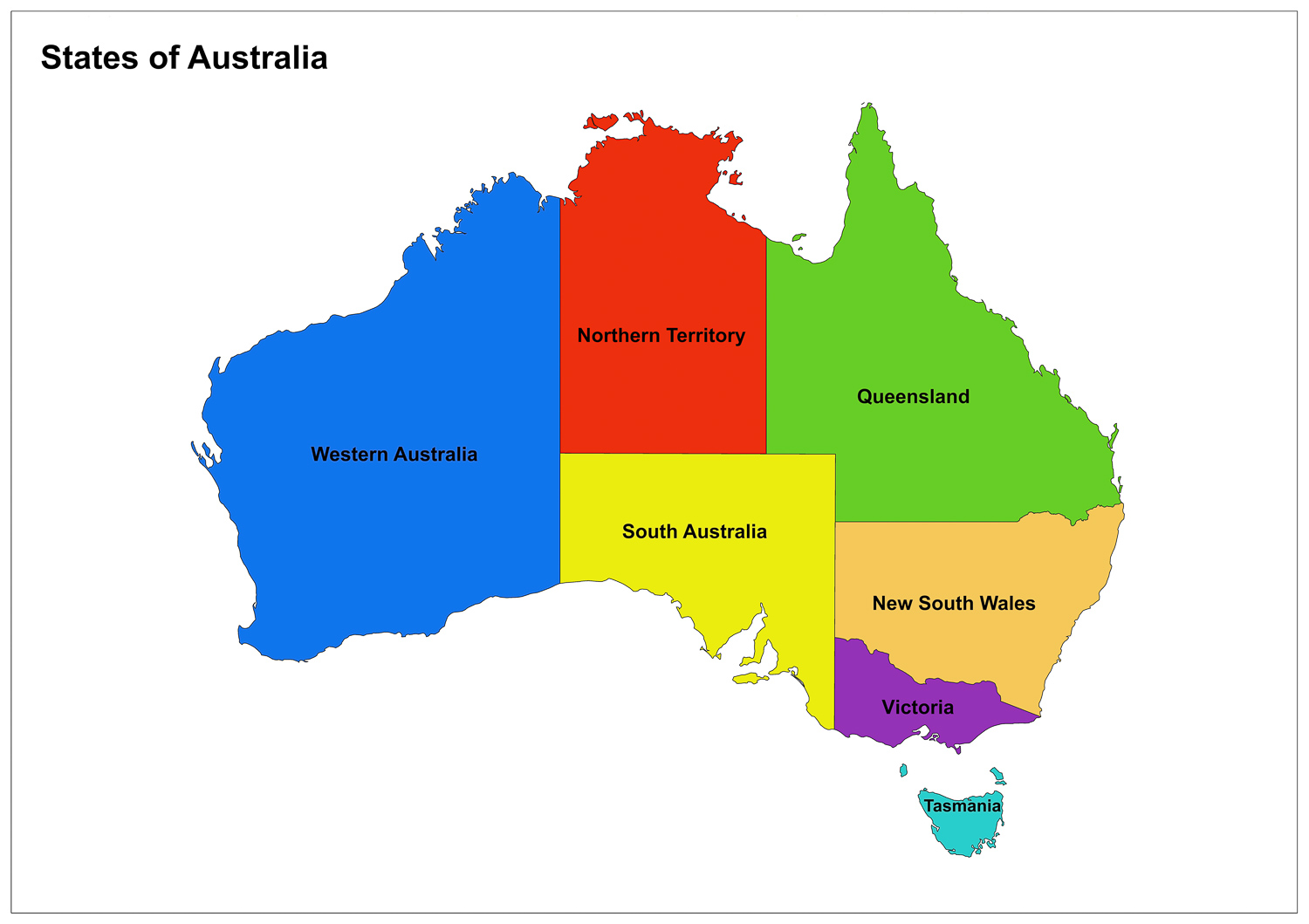

Property prices in Australia have always been a hot topic of discussion. The real estate market in the country has experienced significant fluctuations over the years, influenced by various factors such as economic conditions, government policies, population growth, and regional developments. In this article, we will explore the current state of property prices in Australia and delve into specific regions such as the Gold Coast, Sunshine Coast, Ipswich, Townsville, Melbourne, and Bundaberg. Additionally, we will discuss the outlook for property prices in 2023, providing valuable insights for both buyers and sellers.

Property Prices in Australia: An Overview

Australia has witnessed a remarkable surge in property prices in recent years, particularly in major cities and desirable locations. The demand for housing has outpaced supply, driving up prices and creating a competitive market for buyers. However, the dynamics of property prices can vary significantly across different regions, and it is essential to analyze the local factors influencing the market.

Factors Influencing Property Prices

Several factors contribute to the fluctuations in property prices in Australia. Let’s examine some of the key determinants:

Supply and Demand: The balance between the number of available properties and the number of potential buyers greatly affects property prices. When demand exceeds supply, prices tend to rise.

Economic Conditions: The overall state of the economy, including factors like employment rates, income levels, and interest rates, has a substantial impact on property prices. A strong economy usually translates to higher property prices.

Government Policies: Government regulations and policies, such as tax incentives for homebuyers or restrictions on foreign investment, can directly influence property prices.

Population Growth: Rapid population growth, particularly in urban areas, can lead to increased demand for housing, subsequently driving up property prices.

Infrastructure Development: The presence of quality infrastructure, including transportation networks, schools, hospitals, and recreational facilities, can enhance the desirability of an area, resulting in higher property prices.

Property Prices in Australia: What’s Happening Now?

The Australian property market has experienced some notable trends in recent times. Let’s take a closer look at the current situation and explore specific regions.

Property Prices in the Gold Coast

The Gold Coast, renowned for its stunning beaches and vibrant lifestyle, has witnessed a surge in property prices. The region’s desirability as a tourist destination, coupled with its growing population, has contributed to increased demand for housing. According to recent data, property prices in the Gold Coast have risen by an average of 10% in the past year alone. This upward trend indicates a flourishing real estate market in the area.

Property Prices on the Sunshine Coast

Similar to the Gold Coast, the Sunshine Coast has experienced a considerable rise in property prices. Its picturesque landscapes, relaxed atmosphere, and improving infrastructure have attracted both local and interstate buyers. Recent reports suggest that property prices on the Sunshine Coast have increased by approximately 8% over the past year. This steady growth indicates a promising investment climate in the region.

Property Prices in Ipswich

Ipswich, located near Brisbane, has emerged as an affordable alternative for homebuyers seeking more affordable options. The region has experienced steady growth in property prices, making it an attractive market for first-time buyers and investors. Recent data indicates that property prices in Ipswich have risen by approximately 7% in the last year. With ongoing infrastructure projects and planned developments, Ipswich’s property market shows promising potential.

Property Prices in Townsville

Townsville, situated in North Queensland, has witnessed a unique property market dynamic influenced by its geographical location and economic factors. The region has faced challenges in recent years, including the impact of natural disasters and a slower economy. However, Townsville’s property market has shown signs of recovery, with property prices gradually increasing. Over the past year, property prices in Townsville have risen by approximately 5%. As the region continues to rebuild and attract investments, the property market is expected to stabilize and grow further.

Property Prices in Melbourne

Melbourne, the capital city of Victoria, has experienced a strong property market in recent years. However, the city has recently faced a moderation in price growth due to various factors such as tighter lending restrictions and the impact of the COVID-19 pandemic. Nonetheless, property prices in Melbourne remain relatively high compared to other regions in Australia. As the city continues to recover from the pandemic and regain economic momentum, property prices are expected to stabilize and potentially experience growth in the coming years.

Property Prices in Bundaberg

Bundaberg, located in Queensland, offers a more affordable property market compared to major cities. The region’s attractive lifestyle, access to natural wonders, and affordable housing options have garnered interest from buyers. Recent data suggests that property prices in Bundaberg have increased by approximately 4% in the past year. The region’s affordability and potential for growth make it an appealing choice for buyers looking for affordable property investments.

Property Prices in 2023: What to Expect?

As we enter 2023, it is crucial to understand the projected trends and outlook for property prices in Australia. While it is challenging to predict the exact trajectory of the market, several factors provide insights into what we can expect.

Regional Growth Opportunities

While major cities have traditionally attracted significant attention, regional areas are expected to gain prominence as viable alternatives for buyers. Affordability, improved infrastructure, and the ability to work remotely have contributed to the growing appeal of regional markets. As a result, property prices in certain regional areas, such as the Gold Coast, Sunshine Coast, Ipswich, and Bundaberg, may experience steady growth in 2023.

Government Initiatives

Government policies and initiatives will play a crucial role in shaping the property market in 2023. Measures to support first-time homebuyers, stimulate construction activity, and address housing affordability are expected to impact property prices. Buyers and investors should stay informed about any changes in government policies that could influence the property market.

Sustainable Growth and Long-term Investments

The focus on sustainability and environmentally friendly practices is gaining momentum in the real estate sector. Properties with sustainable features and energy-efficient designs are likely to attract higher demand and potentially command higher prices. Buyers should consider long-term investments in properties that align with sustainability principles to secure future growth potential.

FAQs about Property Prices in Australia

Q: Are property prices in Australia still rising? A: Yes, property prices in Australia have shown an overall upward trend, driven by factors such as supply and demand dynamics, economic conditions, and population growth.

Q: Which regions in Australia have experienced the highest property price growth? A: Regions such as the Gold Coast, Sunshine Coast, and major cities like Melbourne have witnessed significant growth in property prices.

Q: Are property prices in regional areas more affordable than in major cities? A: Generally, property prices in regional areas tend to be more affordable than those in major cities. However, specific regions may vary, and thorough research is essential.

Q: How do government policies impact property prices in Australia? A: Government policies, such as tax incentives for homebuyers or restrictions on foreign investment, can directly influence property prices by altering demand and supply dynamics.

Q: What factors should I consider before investing in the Australian property market? A: Factors such as location, economic conditions, infrastructure development, and long-term growth potential should be carefully assessed before making any investment decisions.

Q: Are property prices expected to continue rising in 2023? A: While property prices are subject to various factors, the overall outlook suggests a stable and potentially growing market in 2023.

Q: Who is the best person to speak to about property prices? A: When it comes to property prices, it is advisable to consult with a real estate agent or property market expert. They possess the knowledge and expertise to provide you with accurate and up-to-date information about property prices in your desired area.

Q: If I want to sell my property, do I need to sign a contract? A: Yes, when selling a property, it is customary to sign a contract of sale. The contract outlines the terms and conditions of the sale, including the agreed-upon price, settlement date, and other essential details. It is essential to engage a professional conveyancer or solicitor who can guide you through the process and ensure that the contract meets all legal requirements.

Q: Will there be any more interest rate rises? A: The decision to raise or lower interest rates lies with the central bank or monetary authority of a country. It is challenging to predict future interest rate movements accurately, as they are influenced by various economic factors. It is advisable to stay informed about economic indicators and consult with financial experts to gain insights into potential interest rate changes.

Property prices in Australia continue to capture the attention of buyers, sellers, and investors alike. Understanding the dynamics of the real estate market and the factors influencing property prices is crucial for making informed decisions. The Gold Coast, Sunshine Coast, Ipswich, Townsville, Melbourne, and Bundaberg represent diverse regions, each with its own unique opportunities and considerations.

As we navigate through 2023, the Australian property market is expected to recover and regain stability. Regional areas offer potential growth opportunities, while government policies and sustainability considerations will shape the market. By staying informed and conducting thorough research, buyers and sellers can navigate the property market with confidence.

This is general advice only, for specific legal advice speak to your legal representative.