Stamp Duty Law QLD Guide 2024 – The Basics

What is stamp duty

Stamp duty, also known as transfer duty, is a tax that is imposed by state and territory governments in Australia on certain transactions, such as the purchase of real property or the transfer of land. The amount of stamp duty payable varies depending on the value of the transaction and the state or territory in which the transaction takes place.

When purchasing property, stamp duty is typically calculated as a percentage of the purchase price and is payable by the buyer. Stamp duty rates can vary significantly between states and territories, and there may be exemptions or concessions available for certain types of transactions, such as first home buyers or those purchasing off-the-plan properties.

Stamp duty is an important source of revenue for state and territory governments and is used to fund a range of public services and infrastructure projects. It’s important to factor in stamp duty costs when budgeting for a property purchase, as it can be a significant expense.

Who pays stamp duty?

In Queensland, stamp duty is typically paid by the buyer of the property. The buyer is responsible for paying the stamp duty to the Queensland Government within 30 days of the date of unconditional or the date of transfer of the property. In some cases, such as when the property is gifted or transferred as part of a divorce settlement, stamp duty may not be payable or may be payable at a reduced rate. It’s always a good idea to check with a qualified conveyancer or solicitor to determine if any exemptions or concessions apply to your specific situation.

Stamp Duty Queensland

Stamp duty in Queensland is calculated based on the value of the property being purchased and is payable by the buyer. The amount of stamp duty payable varies depending on the purchase price and other factors such as whether the property is being used as a primary residence or an investment property.

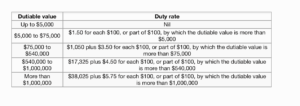

As of 2023, the stamp duty rates for residential property purchases in Queensland are as follows:

Dutiable value

Duty rate

- Not more than $5,000

- Nil

- More than $5,000 up to $75,000

- $1.50 for each $100, or part of $100, over $5,000

- $75,000 to $540,000

- $1,050 plus $3.50 for each $100, or part of $100, over $75,000

- $540,000 to $1,000,000

- $17,325 plus $4.50 for each $100, or part of $100, over $540,000

- More than $1,000,000

- $38,025 plus $5.75 for each $100, or part of $100, over $1,000,000

It’s important to note that stamp duty rates and thresholds can change over time, so it’s always a good idea to check the current rates and thresholds with the Queensland Government or a qualified conveyancer or solicitor before purchasing a property.

You can access the Qld stamp duty calculator here

Is transfer duty included in Conveyancer fees?

No, your conveyancer will not include the transfer duty in their fees. It is the buyer’s responsibility to pay the stamp duty to the Queensland Government. However, your conveyancer will be able to advise you on how much stamp duty you will need to pay and when it is due. They can also assist you in completing the necessary forms and documents required to pay the stamp duty, and may even be able to facilitate the payment process for you. So while your conveyancer will not pay the stamp duty on your behalf, they can provide valuable guidance and support throughout the entire property buying process, including with regard to stamp duty.

How can an exemption of stamp duty occur?

There are several situations in which you may be exempt from paying stamp duty in Queensland. These include:

- First home buyers: First home buyers may be eligible for a full or partial exemption from stamp duty if they meet certain criteria. For example, the property must be their first home, and the purchase price must be under a certain threshold.

- Family transfers: If a property is transferred between family members as a gift or as part of an inheritance, stamp duty may not be payable.

- Certain types of businesses: Some types of businesses, such as non-profit organizations or charities, may be exempt from paying stamp duty.

- Certain types of transactions: Some types of transactions, such as the transfer of a property from a deceased estate to a beneficiary, may be exempt from stamp duty.

It’s important to note that the specific exemptions and concessions that may be available to you will depend on your individual circumstances and the current legislation in Queensland. A qualified conveyancer or solicitor can advise you on whether you may be eligible for any stamp duty exemptions or concessions based on your situation.

Does a seller have to pay stamp duty when they get a contract of sale?

No, the seller does not have to pay stamp duty when they receive a contract of sale. In Queensland, it is the responsibility of the buyer to pay the stamp duty on a property purchase. The amount of stamp duty payable is generally based on the purchase price of the property, and is calculated according to a sliding scale. The buyer must pay the stamp duty within 30 days of the contract becoming unconditional or the transfer of the ownership, wherever is sooner.

However, it’s worth noting that the seller may be responsible for paying any outstanding rates, taxes or other fees associated with the property up to the date of settlement. Your conveyancer or solicitor can advise you on any additional costs or fees you may be responsible for as a seller.

Is there any benefits to using an experienced conveyancing firm in relation to stamp duty?

Yes, there can be several benefits to using an Experienced Conveyancing firm in relation to stamp duty. Here are a few examples:

- Expert advice: An experienced conveyancer or solicitor will have a deep understanding of the current legislation in Queensland relating to stamp duty. With their Industry Knowledge they can advise you on any exemptions or concessions that may be available to you, as well as help you calculate the amount of stamp duty payable based on your specific circumstances.

- Reduced risk of errors: The process of calculating and paying stamp duty can be complex and confusing. By working with an experienced conveyancing firm, you can reduce the risk of errors or mistakes that could result in delays, additional costs or legal issues down the track.

- Streamlined process: An experienced and professional conveyancing firm will have a well-established process for dealing with stamp duty payments. This can help to ensure that the payment is made on time and in accordance with all legal requirements, which can help to speed up the settlement process and reduce stress for all parties involved.

- Access to technology: Many experienced conveyancing firms use advanced technology and software to help streamline the stamp duty payment process. This can help to ensure that payments are made quickly and accurately, and can also help to reduce the administrative burden on buyers and sellers.

Overall, using an experienced conveyancing firm can help to ensure that the stamp duty process runs smoothly and efficiently, which can help to reduce stress and ensure a successful property transaction.

Can stamp duty be paid on settlement as part of the Pexa settlement?

Yes, stamp duty can be paid as part of a PEXA settlement. PEXA is an electronic settlement platform that enables the parties involved in a property transaction to complete the settlement process online. One of the benefits of using PEXA is that it allows for the seamless integration of stamp duty payments as part of the settlement process.

When using PEXA, the buyer’s conveyancer or solicitor can electronically lodge the transfer and pay the stamp duty through the platform. The stamp duty payment is then automatically verified and processed by the relevant state revenue office. This means that the stamp duty payment is made and settled on the day of settlement, which can help to simplify the process and reduce the risk of delays or errors.

It’s worth noting that not all states in Australia currently allow for electronic stamp duty payments via PEXA, so it’s important to check with your conveyancer or solicitor to confirm the specific requirements in your state.

Does stamp duty fees change depending on Councils in QLD?

No, stamp duty in Queensland does not generally vary depending on which local council area the property is located in, including Mackay Council, Brisbane Council, Sunshine Coast Council, or Gold Coast Council. The amount of stamp duty payable is based on the dutiable value of the property and the relevant stamp duty rates set by the Queensland Government.

However, it’s important to note that some local councils in Queensland may impose additional charges or levies on property transactions, such as infrastructure charges, change of ownership fees or council rates. These charges are separate from stamp duty and can vary depending on the local council area and the specific property being bought or sold.

Your conveyancer or solicitor can advise you on any additional charges or levies that may apply to your property transaction, as well as provide guidance on how to calculate and pay stamp duty in accordance with the relevant Queensland legislation.

What Government Department charges stamp duty?

In Queensland, stamp duty is charged by the Queensland Government’s Office of State Revenue. The Office of State Revenue is responsible for administering a range of state taxes and duties, including stamp duty on property transactions. They are also responsible for ensuring compliance with relevant legislation, processing and verifying stamp duty payments, and maintaining records of property transactions in Queensland. If you have any questions or concerns about stamp duty or other state taxes and duties in Queensland, you can contact the Office of State Revenue directly for assistance.

Stamp Duty In NSW & QLD

Buying a property is a significant investment, and it comes with many additional costs that need to be factored in. One of these costs is stamp duty, a tax levied on the purchase of property. In this article, we will discuss everything you need to know about stamp duty in New South Wales (NSW).

Understanding Stamp Duty

Stamp duty is a state tax, and the amount charged varies depending on which state or territory the property is located in. The tax is calculated based on the purchase price of the property and is paid by the buyer.

Who Pays Stamp Duty in NSW?

In NSW, the buyer is responsible for paying stamp duty. It is important to note that stamp duty is a one-time tax that must be paid before the property’s settlement.

How is Stamp Duty Calculated in NSW?

Stamp duty in NSW is calculated on a sliding scale based on the purchase price of the property. The higher the purchase price, the more stamp duty you will have to pay. Additionally, stamp duty is calculated differently for owner-occupied properties and investment properties.

For owner-occupied properties, the following rates apply:

- Properties up to $14,000: Exempt from stamp duty

- Properties between $14,001 and $31,000: $1.25 for every $100 or part of $100 above $14,000

- Properties between $31,001 and $83,000: $172.50 plus $1.50 for every $100 or part of $100 above $31,000

- Properties between $83,001 and $310,000: $1,090 plus $1.75 for every $100 or part of $100 above $83,000

- Properties between $310,001 and $1,000,000: $4,685 plus $3.50 for every $100 or part of $100 above $310,000

- Properties over $1,000,000: $41,820 plus $4.50 for every $100 or part of $100 above $1,000,000

For investment properties, the following rates apply:

- Properties up to $14,000: Exempt from stamp duty

- Properties between $14,001 and $31,000: $1.25 for every $100 or part of $100 above $14,000

- Properties between $31,001 and $83,000: $172.50 plus $1.50 for every $100 or part of $100 above $31,000

- Properties between $83,001 and $310,000: $1,090 plus $1.75 for every $100 or part of $100 above $83,000

- Properties between $310,001 and $1,000,000: $4,685 plus $4.50 for every $100 or part of $100 above $310,000

- Properties over $1,000,000: $45,820 plus $5.50 for every $100 or part of $100 above $1,000,000

Additional Stamp Duty Costs

In addition to the standard stamp duty fees, there may be additional costs that need to be factored in, such as:

- Mortgage registration fee: This is a fee charged by the NSW Government to register your mortgage. The fee is calculated based on the amount of your mortgage and is paid by the buyer.More Stamp Duty informationFAQS